Unpacking the Spread Bet Meaning

Discover the true spread bet meaning with this guide. We explain how it works with real examples, covering the benefits, risks, and core mechanics for traders.

Ever wondered how traders play the markets without actually buying a single share, barrel of oil, or ounce of gold? Welcome to the world of spread betting.

Instead of purchasing an asset, you're simply placing a bet on which way you think its price will move. Will it go up, or will it come down? Your profit or loss isn't a fixed amount; it's directly tied to how right or wrong your prediction turns out to be.

What Is Spread Betting in Practice?

Let's put the financial jargon aside for a second. Think of it like betting on a football match, but instead of just picking the winner, you’re predicting the final score. You're not just saying "Team A will win," you're betting on how much they'll win by. The more accurate your prediction, the bigger your payout. On the flip side, the more you miss the mark, the more you could lose.

That's the core idea. You're not owning stocks or currencies; you're betting on their future price. The broker gives you a price range—the "spread"—which has a buy price and a sell price. Your job is to decide whether the market will finish above or below that range.

Going Long vs. Going Short

At the end of the day, every spread bet comes down to one of two moves:

- Going Long (Buying): You do this when you think the market is heading up. If you've got a good feeling about a company's shares, you’d "buy" the market, or go long.

- Going Short (Selling): This is your play when you expect the market to fall. If you believe a currency pair is about to drop, you’d "sell" the market, or go short.

This power to potentially profit from a falling market is a massive draw for many traders. It offers a kind of flexibility you just don't get with traditional investing, which usually relies on prices climbing. If you're new to this kind of speculation, getting a grip on how to read betting odds can build a great foundation.

At its heart, spread betting is about backing your judgement. You are rewarded based on the magnitude of your correctness, offering a dynamic alternative to the fixed win-or-lose nature of traditional betting.

Ultimately, spread betting opens the door to thousands of global markets, and you don't need a huge amount of capital to get started because you never actually own the underlying asset.

A Look Under the Bonnet: How a Spread Bet Actually Works

To really get your head around spread betting, you need to understand what makes it tick. Think of it like a high-performance engine; it’s powered by three core components that all work together. Get a handle on these, and you're in a much better position to control your trades.

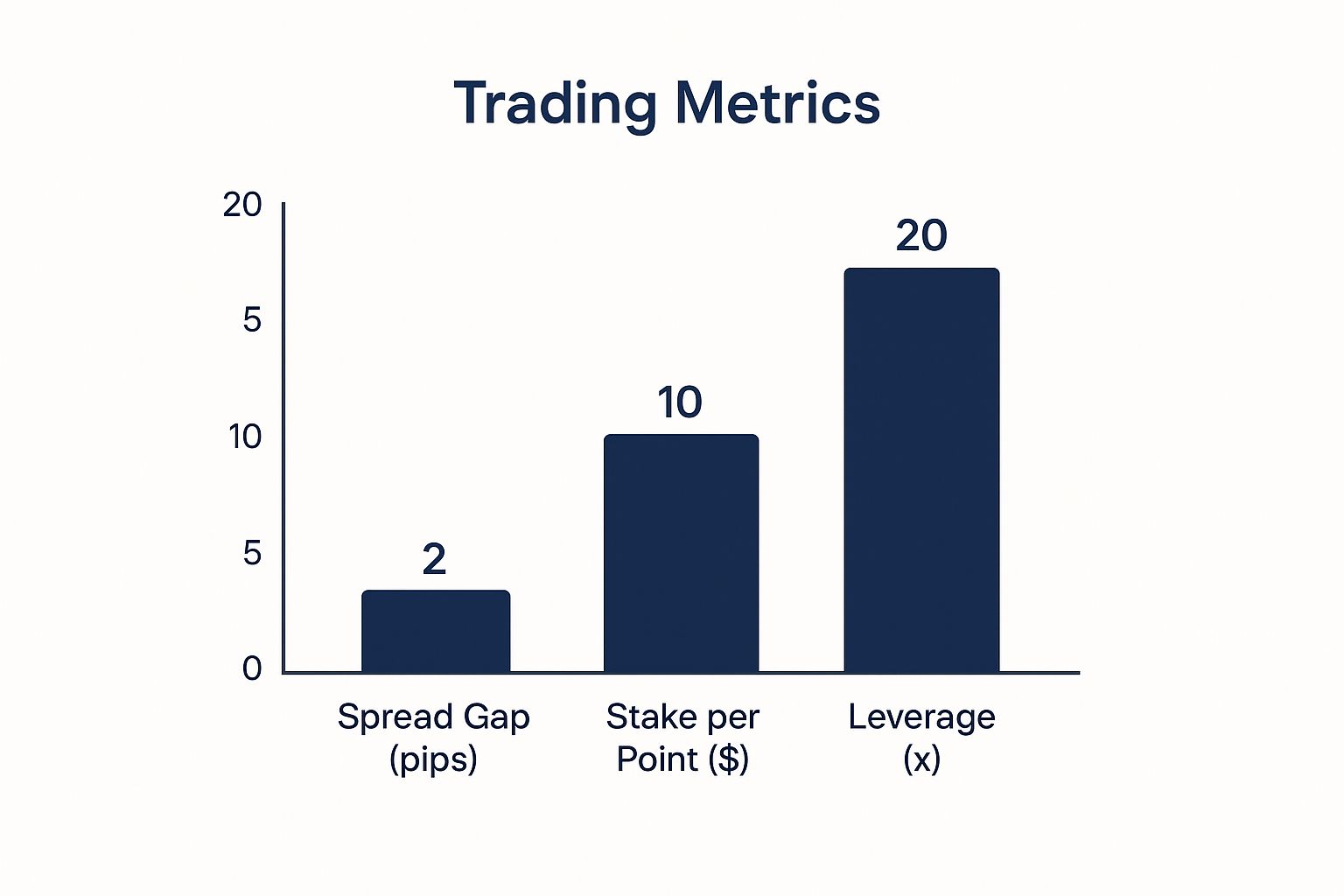

The Spread, The Stake, and The Leverage

First up is the spread. This is simply the small gap between the 'buy' and 'sell' price a broker gives you. It’s how they make their money, which is why you often won’t see any separate commissions on your trades.

Then you have your stake. This isn't like a traditional bet where you just place a lump sum. In spread betting, your stake is the amount of money you decide to risk for every single point the market moves. So, a £2 stake means you'll make or lose £2 for each point that moves in your favour or against you.

Finally, and perhaps most importantly, there's leverage. This is what gives spread betting its power. Leverage lets you open a large position in the market with only a small initial deposit, which is called the margin. It essentially magnifies your exposure, which is great for profits but also means it can amplify your losses just as dramatically.

This infographic breaks down how these three elements fit together.

You can see how the broker's fee (the spread), your risk per point (the stake), and the powerful force multiplier (leverage) all play a distinct role.

Leverage is a double-edged sword. It provides access to significant market positions without committing large sums of capital, but it demands careful risk management to protect against amplified losses.

This unique structure has made speculative trading more accessible than ever before. You can see this trend everywhere. Take the Romanian betting industry, for example, which saw consumers spend a staggering €2.4 billion in 2022 alone. This shows a massive public appetite for markets with uncertain outcomes. You can read more about this explosive growth and its implications in this insightful report on the gambling industry in Romania.

The mechanics of spread betting, especially leverage, are a huge part of what makes this kind of trading so accessible. To get a feel for just how fast modern markets move, have a look at our guide on real-time odds tracking.

Seeing Spread Bets in Action with Real Examples

Theory is one thing, but seeing how a spread bet plays out in the real world is where it all starts to make sense. Let's walk through a couple of classic examples to bring the concept to life.

H3: Example 1: Going Long on a Rising Stock Index

Let's say you've got a good feeling about the UK 100 index. You think it's undervalued and due for a climb from its current price of 7,500.

Your spread betting provider offers a price of 7499 – 7501. Since you're backing the index to go up, you need to ‘buy’ the bet, also known as going 'long'. This means you open your position at the higher price of 7501.

You decide to stake £5 per point. This is the crucial bit. For every single point the index moves above your entry price, you make £5. For every point it drops below, you lose £5.

A few days pass, and your hunch was spot on. The UK 100 has rallied to 7,551. To cash in, you close your trade.

The calculation is straightforward:

- Market Movement: 7,551 (closing price) - 7,501 (opening price) = 50 points in your favour.

- Total Profit: 50 points x £5 stake = £250.

H3: Example 2: Going Short on a Falling Currency Pair

Now for the flip side. You've been watching the EUR/USD currency pair, and you believe it's overbought and about to drop from its current level of 1.1250.

The broker's spread is 1.1249 – 1.1251. Because you expect the price to fall, you ‘sell’ the bet (go 'short') at the lower price of 1.1249.

This time, you're a bit more confident, so you stake £10 per point.

Unfortunately, the market moves against you, and the EUR/USD pair climbs to 1.1269. To cut your losses, you decide to close the position.

Here's how the damage is calculated:

- Market Movement: 1.1269 (closing price) - 1.1249 (opening price) = 20 points against you.

- Total Loss: 20 points x £10 stake = £200.

These examples highlight the absolute core of spread betting. Your profit or loss isn't a fixed amount; it's directly tied to how much the market moves. The more right you are, the more you win. But the more wrong you are, the more you stand to lose.

To give you a clearer picture, here’s a table breaking down how these scenarios work.

H3: Spread Bet Profit and Loss Scenarios

| Scenario | Stake per Point | Market Movement | Calculation | Result (Profit/Loss) |

|---|---|---|---|---|

| Going Long | £5 | UK 100 rises by 50 points (7501 to 7551) | (7551 - 7501) x £5 | £250 Profit |

| Going Long | £5 | UK 100 falls by 30 points (7501 to 7471) | (7471 - 7501) x £5 | -£150 Loss |

| Going Short | £10 | EUR/USD falls by 15 points (1.1249 to 1.1234) | (1.1249 - 1.1234) x £10 | £150 Profit |

| Going Short | £10 | EUR/USD rises by 20 points (1.1249 to 1.1269) | (1.1249 - 1.1269) x £10 | -£200 Loss |

This table neatly summarises the direct relationship between market movement, your stake, and the final outcome.

While we've focused on financial markets, the same fundamental principles apply to more complex sports betting systems. If you're used to combination bets, you might be interested in our guide on what is a round robin bet to see how intricate betting structures can be built.

So, Why Do Traders Actually Use Spread Betting?

With so many ways to trade, what is it about spread betting that pulls so many people in? It really boils down to a few powerful advantages that you just don't get with more traditional methods.

For a lot of traders, especially here in the UK, the biggest draw is how tax-efficient it can be. Profits from spread betting are often completely free from Capital Gains Tax and Stamp Duty. That’s a huge deal. It means more of your hard-earned profit stays in your pocket, which can make a massive difference to your bottom line over time.

But it’s not just about the tax man. Spread betting offers incredible strategic freedom. You aren't just stuck hoping for markets to go up. If you think a company's stock or an entire index is headed for a fall, you can go short and potentially profit from the downturn. This ability to play both sides of the market gives you opportunities no matter which way the wind is blowing.

Unlocking the Markets with Ease

The practical benefits don't end there. Spread betting platforms are designed to make trading straightforward and accessible.

- Trade Around the Clock: Global markets don't sleep, and neither do your opportunities. You can trade major indices, forex pairs, and commodities 24 hours a day, letting you react to breaking news instantly.

- No Commission Fees: This is a big one. Your cost is built right into the spread itself. There are no sneaky broker commissions or extra fees to calculate, making your profit and loss much clearer.

- One Account, Thousands of Markets: Forget juggling different accounts for different assets. A single spread betting account can give you access to thousands of instruments—from Apple shares to the price of gold to the FTSE 100.

At its core, spread betting's appeal is a powerful mix: it’s tax-smart, agile enough for any market direction, and strips away a lot of the usual trading costs and complexities.

This all comes together to create an environment where you can focus purely on your trading strategy, not on getting bogged down by complicated fee structures.

Navigating the Inherent Risks of Spread Betting

Look, anyone who tells you trading is all upside is selling you a fantasy. A responsible trader is an informed one, and if you truly want to grasp what spread betting is all about, you have to respect the risks. The biggest one, without a doubt, is leverage.

Leverage is a double-edged sword. It’s what gives you the power to see significant gains from small market movements, but that sword cuts both ways. When the market turns against you, your losses can be magnified just as quickly and just as powerfully.

This brings us to a critical point: you can lose more than your initial deposit. If a trade goes badly south, your broker could hit you with a ‘margin call’. That’s when they demand you either add more money to your account or close the position to cover your mounting losses. Trust me, it’s a situation every trader wants to avoid.

Your Essential Risk Management Toolkit

Fortunately, you’re not flying blind. Modern trading platforms come equipped with some essential tools designed to help you manage your exposure and protect your capital. Think of them as your safety net.

The most crucial tool in your arsenal is the stop-loss order. When you open a trade, you set this order at a specific price point. If the market moves against you and hits that price, your position is automatically closed, capping your loss right there.

A stop-loss isn't just a feature on a platform; it's a fundamental part of a disciplined trading strategy. It removes the emotion from the decision to cut a losing trade, saving you from the dangerous temptation to just "hold on and hope".

This kind of discipline is non-negotiable, especially in fast-moving markets. For context, consider the growth in speculative activities. The Romanian online gambling sector, for instance, is projected to be worth around £900 million by 2025. That highlights a massive appetite for this kind of market engagement. You can learn more about the growth of Romania's iGaming market to see just how popular these activities have become.

By embracing tools like stop-loss orders, you're not admitting defeat—you're trading smart. You're approaching the markets with a healthy respect for the challenges, which is the only way to trade responsibly and protect your hard-earned capital from a sudden, volatile swing.

Got Questions About Spread Betting? Let's Get Them Answered

Alright, let's wrap this up by tackling some of the questions I hear all the time from people new to spread betting. Getting straight answers to these will clear up any confusion and help you feel more confident before you even think about placing a trade.

Is Spread Betting Just Another Form of Gambling?

That's the million-dollar question, isn't it? While it definitely involves risk and speculation, it's not the same as putting your money on a horse because you like its name. Successful traders don't rely on luck; they lean on solid market analysis, a well-thought-out strategy, and strict risk management. They're digging into charts, economic data, and news to make informed decisions, not just taking a punt.

That said, because you're using leverage, you can lose more than your initial deposit. That's a serious financial risk, so you absolutely have to treat it with the same respect and caution you'd give any high-stakes financial activity.

Think of spread betting as sitting somewhere between traditional investing and fixed-odds gambling. It rewards skill and strategy, but it has the high stakes and fast-paced nature you’d associate with betting.

What Markets Can I Actually Spread Bet On?

One of the best things about spread betting is the sheer variety of markets you can access from a single account. Most brokers give you a huge playground of global instruments, so you can act on opportunities wherever you see them popping up.

Typically, you'll be able to trade on:

- Major Stock Indices: Think the FTSE 100, S&P 500, and the German DAX 40.

- Individual Company Shares: From household names like Apple and Tesla to local market champions.

- Forex Pairs: The biggest market on the planet, including popular pairs like EUR/USD and GBP/JPY.

- Commodities: Everything from precious metals like gold and silver to energies like crude oil.

This incredible flexibility means you can follow your insights, no matter which corner of the market they lead you to.

How Much Cash Do I Need to Get Started?

You might be surprised. Thanks to leverage, you don't need a massive bankroll to get going. You only need to put down a small percentage of a trade’s total value as a deposit, which we call margin. Because of this, some brokers will let you open an account and start trading with just a few hundred pounds.

But here’s a pro tip: don't just fund your account with the bare minimum. It's incredibly wise to have extra capital in there. This gives you a crucial safety net to absorb any losses if a trade moves against you for a bit, so you don't get forced out of your position prematurely.

What on Earth Is a "Margin Call"?

A margin call is basically a warning shot from your broker. It's an alert telling you that the funds in your account have dipped below the minimum level required to keep your trades open. This happens when a position goes against you, and the losses start eating into your account balance.

When you get a margin call, you’ve got two options: either top up your account with more money to meet the requirement or start closing some of your positions to lower your overall risk. If you ignore it, the broker will likely step in and automatically close your trades to stop you—and them—from losing any more money.

Ready to Start Winning?

Join OddsHaven and get instant access to AI-powered predictions with an 87% win rate on high-confidence picks

Try OddsHaven Free for 5 Days